A road marker for swing traders using stock market sentiments and William Gann cycles.

HOW TO JOIN OUR FREE CHAT ROOM

Come join our free private chat room. We have live voice and video chat capability in addition to text chat. There is no fee to join this room. If you are interested, please send an email to sellhigh@stratisgroup.com We will send you an invitation link.

Sunday, June 2, 2013

Friday, April 26, 2013

ping pong to frustrate traders at the top

without giving away too much here, traders in the chat room are perfectly comfortable with what is happening in the market we have a lotto ticket on the short side into the summer. 1593 was our target for the bounce. And now, if we break 1578, then we'll see 1573, and then 1563. Thereafter, we scalp long again to grab another lotto ticket.

if you are interested in finding out more, click on the link below to join the free chat room.

https://hall.com/invites/38ad415e6b

if you are interested in finding out more, click on the link below to join the free chat room.

https://hall.com/invites/38ad415e6b

Tuesday, April 16, 2013

Monday, April 15, 2013

bounce as early as tomorrow or wednesday.

smart money sentiment fell below 50%. maybe one more down day tomorrow and then pump up by wednesday.

price i'm watching are 1552>1545>1539.

fall below the bottom channel and then bounce up to 1579.

price i'm watching are 1552>1545>1539.

fall below the bottom channel and then bounce up to 1579.

Tuesday, April 9, 2013

Retrace and then pump again

On monday, the down trend did not continue per Gann's 3.5 days from the recent top. We saw +divergence on our charts. Since then, smart money p/c sentiment climbed to 100%. It never fell below 50%.

Today, people in the chat room saw negative divergence on 10min chart, so we waited and went short at 1573. This after some people in the chat room going long from 1539. Support at 1562 and at 1556. If you missed going long last Friday, we should have another opportunity in coming days which will catch everyone off guard.

Today, people in the chat room saw negative divergence on 10min chart, so we waited and went short at 1573. This after some people in the chat room going long from 1539. Support at 1562 and at 1556. If you missed going long last Friday, we should have another opportunity in coming days which will catch everyone off guard.

Wednesday, April 3, 2013

Smart Money Sentiment above 80%

Yesterday was 1 year anniversary of 2012 high and we closed at 1570 to post highest close ever for SPX. Today, we pulled back to 1549 and closed above 1553. Minor uptrend channel has been broken. However, larger uptrend trend channel is still in tact. Smart Money sentiment is still showing above 80%, which is still bullish until sentiment is broken below 50%.

McClellan Oscillator is showing oversold, so we may bounce tomorrow. In the short term, I'm watching 3.5 days from yesterday's high for a change in minor trend. It may become a beginning of a major trend, so that would be Monday.

McClellan Oscillator is showing oversold, so we may bounce tomorrow. In the short term, I'm watching 3.5 days from yesterday's high for a change in minor trend. It may become a beginning of a major trend, so that would be Monday.

Friday, March 22, 2013

My Swing system

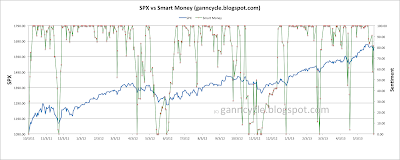

Chart below shows that the market favor the bulls. So going forward, I won't be posting too many charts. Whenever, Smart Money sentiment reads zero, I will post it that night.

Topping is a process. Bottoming is an event.

Topping is a process. Bottoming is an event.

Thursday, February 7, 2013

double doji and engulfing SPX daily

We made coin again in our trading chat room today. We bounced right at the trend/support of the triangle at 1499. I have 2 big numbers. 1516 and 1495. I wouldn't try to predict which way it breaks on the triangle.

However, we do have an engulfing red daily candle with body and tail over yesterday's candle. If we break 1516, we're off to races to 1551. If we break 1495, you already see that there is alot of room left below to 1472.

If you want to join our free chat room, please send an email to sellhigh@stratisgroup.com

Monday, February 4, 2013

McClellan Oscillator sentiment ready for a bounce

SPX 1495>1492 are major support. McClellan Oscillator is possible to bounce as early as tomorrow or Wednesday. Bulls need to clear 1502, which is near the current trend average.

Thursday, January 24, 2013

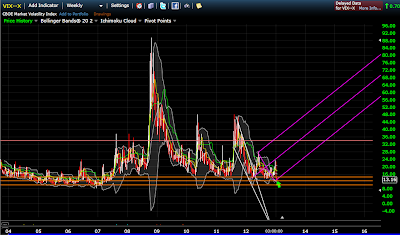

VIX - long term support band

Below is a long term VIX support band chart

Weekly chart indicate we are at major support levels. 3 brown lines represent high, low and midpoint support levels. 12.28 is midpoint.

We cleaned out stops above 1499 to 1502, but we're not near the Gann date, so we may hang around here for a bit to grind out shorts. Smart money needs to digest it's big meal until 1/31 or 2/5

Weekly chart indicate we are at major support levels. 3 brown lines represent high, low and midpoint support levels. 12.28 is midpoint.

We cleaned out stops above 1499 to 1502, but we're not near the Gann date, so we may hang around here for a bit to grind out shorts. Smart money needs to digest it's big meal until 1/31 or 2/5

Tuesday, January 22, 2013

Gann - January 31st and Feb 5th,,, tomorrow is 233 fib days from the low

Smart money is not letting up. Buy the dip intraday, ramp into higher close. There was no sell signal intraday during last several trading days. So the smart money is feasting on shorts. Smart money sentiment chart is shown below. When it stays up at 100, you do not want to short.

SPX/VIX has been above 80 for last 14 trading days. High probability on the short side starting 1/31, which is a gann date.

SPX/VIX Sentiment chart. SPX/VIX is reading the highest in many months.

SPX trendline and gann dates match up to 1/31 and 2/5. 1499 with stop cleaning at 1503.

SPX/VIX has been above 80 for last 14 trading days. High probability on the short side starting 1/31, which is a gann date.

| Probability Of Down | Date | |

| 1 TD later | 67% | 2-Jan |

| 2 TD later | 50% | 3-Jan |

| 3 TD later | 42% | 4-Jan |

| 4 TD later | 57% | 7-Jan |

| 5 TD later | 61% | 8-Jan |

| 6 TD later | 57% | 9-Jan |

| 7 TD later | 65% | 10-Jan |

| 8 TD later | 65% | 11-Jan |

| 9 TD later | 70% | 14-Jan |

| 10 TD later | 74% | 15-Jan |

| 11 TD later | 74% | 16-Jan |

| 12 TD later | 74% | 17-Jan |

| 13 TD later | 83% | 18-Jan |

| 14 TD later | 78% | 22-Jan |

| 15 TD later | 83% | 23-Jan |

| 16 TD later | 83% | 24-Jan |

| 17 TD later | 87% | 25-Jan |

| 18 TD later | 83% | 28-Jan |

| 19 TD later | 91% | 29-Jan |

| 20 TD later | 91% | 30-Jan |

| 21 TD later | 100% | 31-Jan |

| 22 TD later | 100% | 1-Feb |

| 23 TD later | 100% | 4-Feb |

| 24 TD later | 100% | 5-Feb |

| 25 TD later | 100% | 6-Feb |

| 26 TD later | 100% | 7-Feb |

| 27 TD later | 96% | 8-Feb |

| 28 TD later | 96% | |

| 29 TD later | 96% | |

| 30 TD later | 96% |

SPX/VIX Sentiment chart. SPX/VIX is reading the highest in many months.

SPX trendline and gann dates match up to 1/31 and 2/5. 1499 with stop cleaning at 1503.

Tuesday, January 15, 2013

Smart money holding long, for now

Sorry I have not posted in a while.

This is what I'm seeing in smart money sentiments vs. SPX and trend average. 1468 is support. 1461 is the next support. If we dip, it needs to punch through1440.

Bully until these prices break, potential to break 1479. It was a good buying opportunity when both McClellan Oscillator sentiment and Smart Money sentiment were at zero.

This is what I'm seeing in smart money sentiments vs. SPX and trend average. 1468 is support. 1461 is the next support. If we dip, it needs to punch through1440.

Bully until these prices break, potential to break 1479. It was a good buying opportunity when both McClellan Oscillator sentiment and Smart Money sentiment were at zero.

Subscribe to:

Posts (Atom)