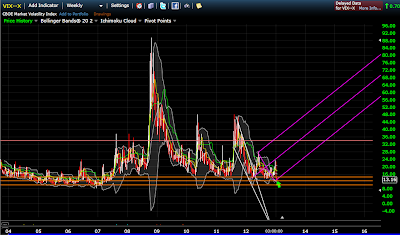

Below is a long term VIX support band chart

Weekly chart indicate we are at major support levels. 3 brown lines represent high, low and midpoint support levels. 12.28 is midpoint.

We cleaned out stops above 1499 to 1502, but we're not near the Gann date, so we may hang around here for a bit to grind out shorts. Smart money needs to digest it's big meal until 1/31 or 2/5

A road marker for swing traders using stock market sentiments and William Gann cycles.

HOW TO JOIN OUR FREE CHAT ROOM

Come join our free private chat room. We have live voice and video chat capability in addition to text chat. There is no fee to join this room. If you are interested, please send an email to sellhigh@stratisgroup.com We will send you an invitation link.

Thursday, January 24, 2013

Tuesday, January 22, 2013

Gann - January 31st and Feb 5th,,, tomorrow is 233 fib days from the low

Smart money is not letting up. Buy the dip intraday, ramp into higher close. There was no sell signal intraday during last several trading days. So the smart money is feasting on shorts. Smart money sentiment chart is shown below. When it stays up at 100, you do not want to short.

SPX/VIX has been above 80 for last 14 trading days. High probability on the short side starting 1/31, which is a gann date.

SPX/VIX Sentiment chart. SPX/VIX is reading the highest in many months.

SPX trendline and gann dates match up to 1/31 and 2/5. 1499 with stop cleaning at 1503.

SPX/VIX has been above 80 for last 14 trading days. High probability on the short side starting 1/31, which is a gann date.

| Probability Of Down | Date | |

| 1 TD later | 67% | 2-Jan |

| 2 TD later | 50% | 3-Jan |

| 3 TD later | 42% | 4-Jan |

| 4 TD later | 57% | 7-Jan |

| 5 TD later | 61% | 8-Jan |

| 6 TD later | 57% | 9-Jan |

| 7 TD later | 65% | 10-Jan |

| 8 TD later | 65% | 11-Jan |

| 9 TD later | 70% | 14-Jan |

| 10 TD later | 74% | 15-Jan |

| 11 TD later | 74% | 16-Jan |

| 12 TD later | 74% | 17-Jan |

| 13 TD later | 83% | 18-Jan |

| 14 TD later | 78% | 22-Jan |

| 15 TD later | 83% | 23-Jan |

| 16 TD later | 83% | 24-Jan |

| 17 TD later | 87% | 25-Jan |

| 18 TD later | 83% | 28-Jan |

| 19 TD later | 91% | 29-Jan |

| 20 TD later | 91% | 30-Jan |

| 21 TD later | 100% | 31-Jan |

| 22 TD later | 100% | 1-Feb |

| 23 TD later | 100% | 4-Feb |

| 24 TD later | 100% | 5-Feb |

| 25 TD later | 100% | 6-Feb |

| 26 TD later | 100% | 7-Feb |

| 27 TD later | 96% | 8-Feb |

| 28 TD later | 96% | |

| 29 TD later | 96% | |

| 30 TD later | 96% |

SPX/VIX Sentiment chart. SPX/VIX is reading the highest in many months.

SPX trendline and gann dates match up to 1/31 and 2/5. 1499 with stop cleaning at 1503.

Tuesday, January 15, 2013

Smart money holding long, for now

Sorry I have not posted in a while.

This is what I'm seeing in smart money sentiments vs. SPX and trend average. 1468 is support. 1461 is the next support. If we dip, it needs to punch through1440.

Bully until these prices break, potential to break 1479. It was a good buying opportunity when both McClellan Oscillator sentiment and Smart Money sentiment were at zero.

This is what I'm seeing in smart money sentiments vs. SPX and trend average. 1468 is support. 1461 is the next support. If we dip, it needs to punch through1440.

Bully until these prices break, potential to break 1479. It was a good buying opportunity when both McClellan Oscillator sentiment and Smart Money sentiment were at zero.

Subscribe to:

Posts (Atom)